My 2025 Benefits

Your BCBS VT Medical Benefits

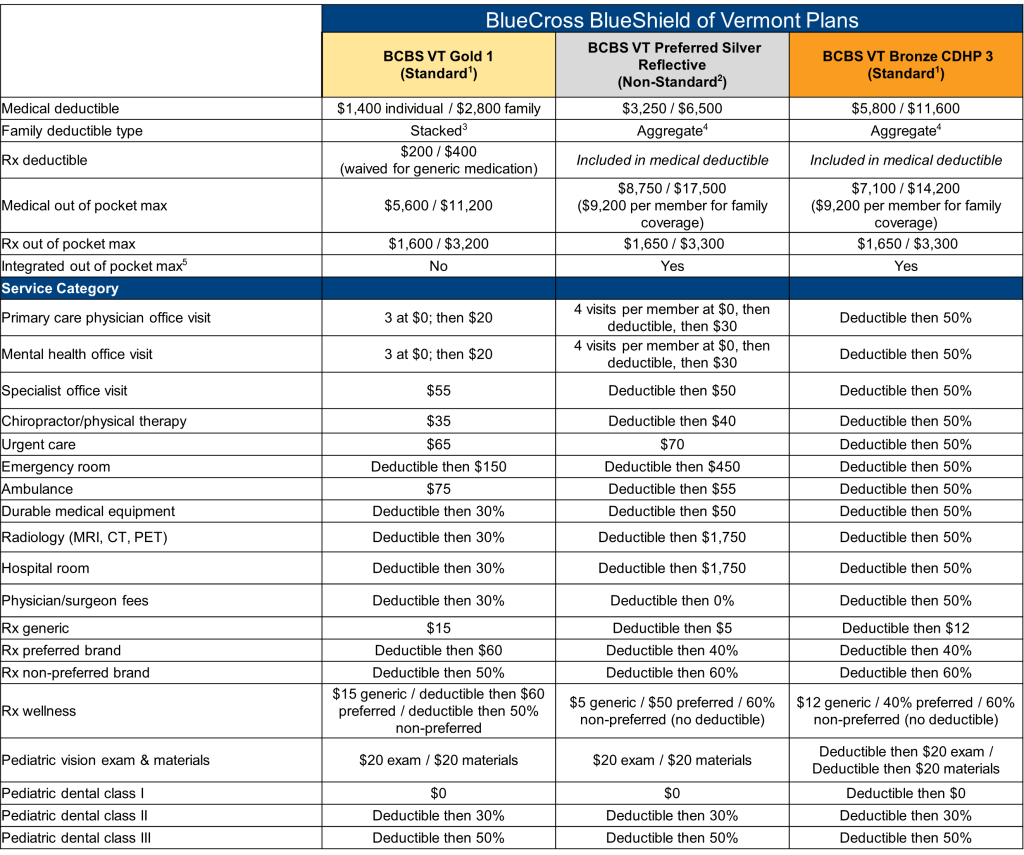

Fulflex offers 3 medical plans from Blue Cross Blue Shield of Vermont:

- Gold 1 (Standard)

- Preferred Silver Reflective (Non-Standard)

- Bronze CDHP 3 (Standard)

BCBS VT Plan Details

Deductibles — The amount you pay each year for eligible in-network and out-of-network charges before the plan begins to pay a portion of the costs.

Copays — A fixed amount you pay for a health care service. Copays do not count toward your annual deductible but do count toward your annual out-of-pocket maximum.

Coinsurances — Once you’ve met your deductible, you and the plan share the cost of care, which is called coinsurance. For example, you may pay 30% for services and the plan pays 70% of the cost until you reach your annual out-of-pocket maximum, depending on which plan you choose.

Out-of-pocket maximums— The most you will pay each year for eligible in- or out-of-network services, including prescriptions. After you reach your out-of-pocket maximum, the plan pays the full cost of eligible health care services for the rest of the year.

1 A Standard health plan provides the same plan design (deductibles, copays, and covered services) across multiple insurance companies, making it easier to compare plans. Standard plans of the same type from different carriers (e.g. the BCBS VT Gold 1 Plan and the MVP Gold 1 Plan) have the same plan design but differ in their provider networks and premiums.

2 A Non-Standard health plan is customized with variations in coverage and pricing beyond the standardized options. These plans offer more variety in plan design and can vary significantly in plan design across different insurance companies. For example, the non-standard Silver Reflective plans of BCBS VT and MVP differ greatly in their deductibles, copays, and cost sharing.

3 A plan with a Stacked family deductible pays benefits to each covered family member who reaches their individual deductible. For example, under the BCBS VT Gold 1 Plan, each individual family member would need to spend $1,400 in medical expenses for their deductible to be reached, and then the plan would start paying expenses for that individual.

4 In a plan with an Aggregate family deductible, the entire family must meet a single deductible amount (regardless of how individual expenses are accrued across covered family members on the plan) before the plan will start paying for benefits. For example, under the BCBS VT Bronze CDHP 3 Plan, all family members covered under the plan must meet the $11,600 deductible collectively (as opposed to $5,800 individually).

5 A plan has an Integrated Out-of-Pocket Maximum when the maximum out-of-pocket amount you pay is combined for both medical and pharmacy services.

BCBS VT Medical Plans – Summary of Benefits and Coverages (SBCs)

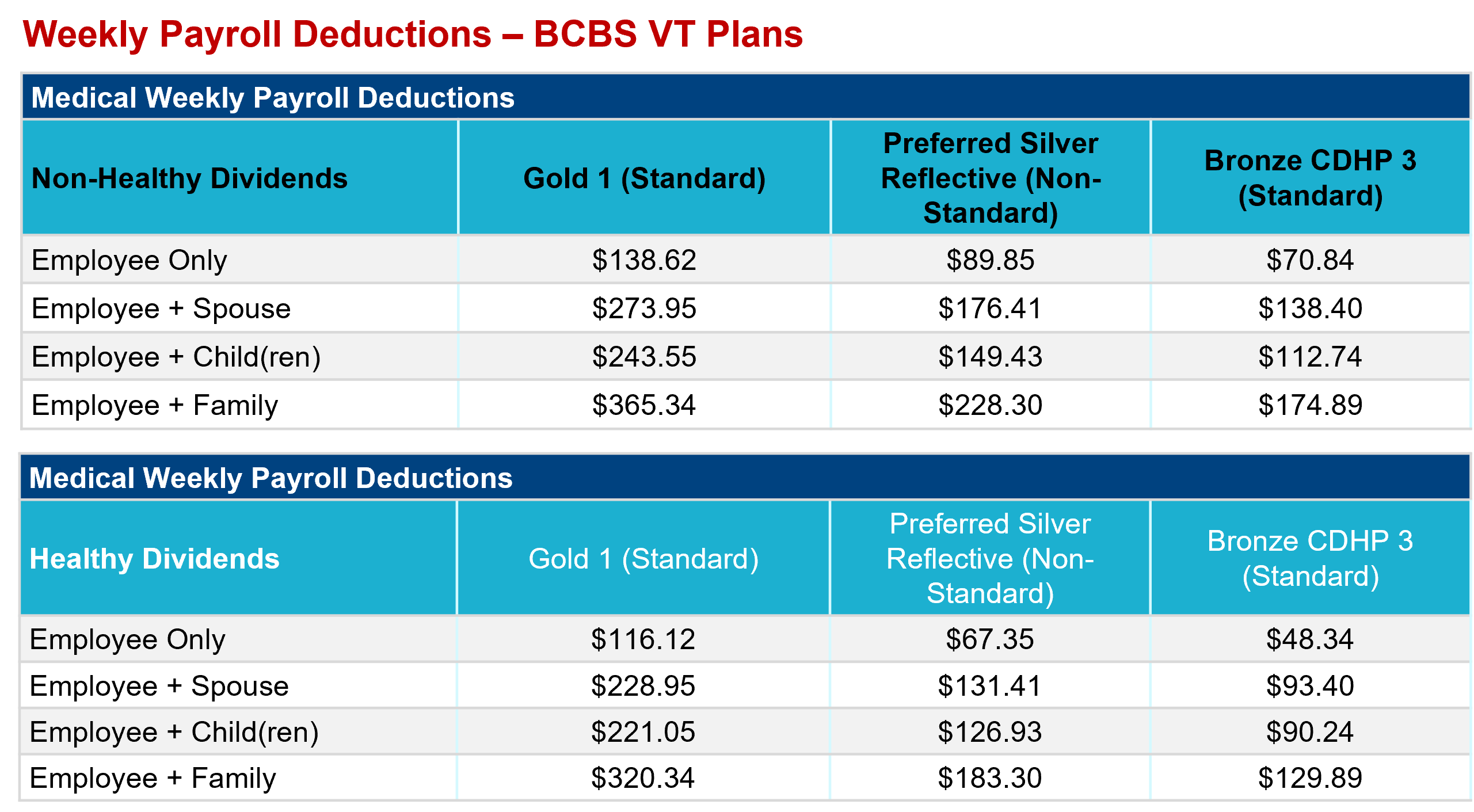

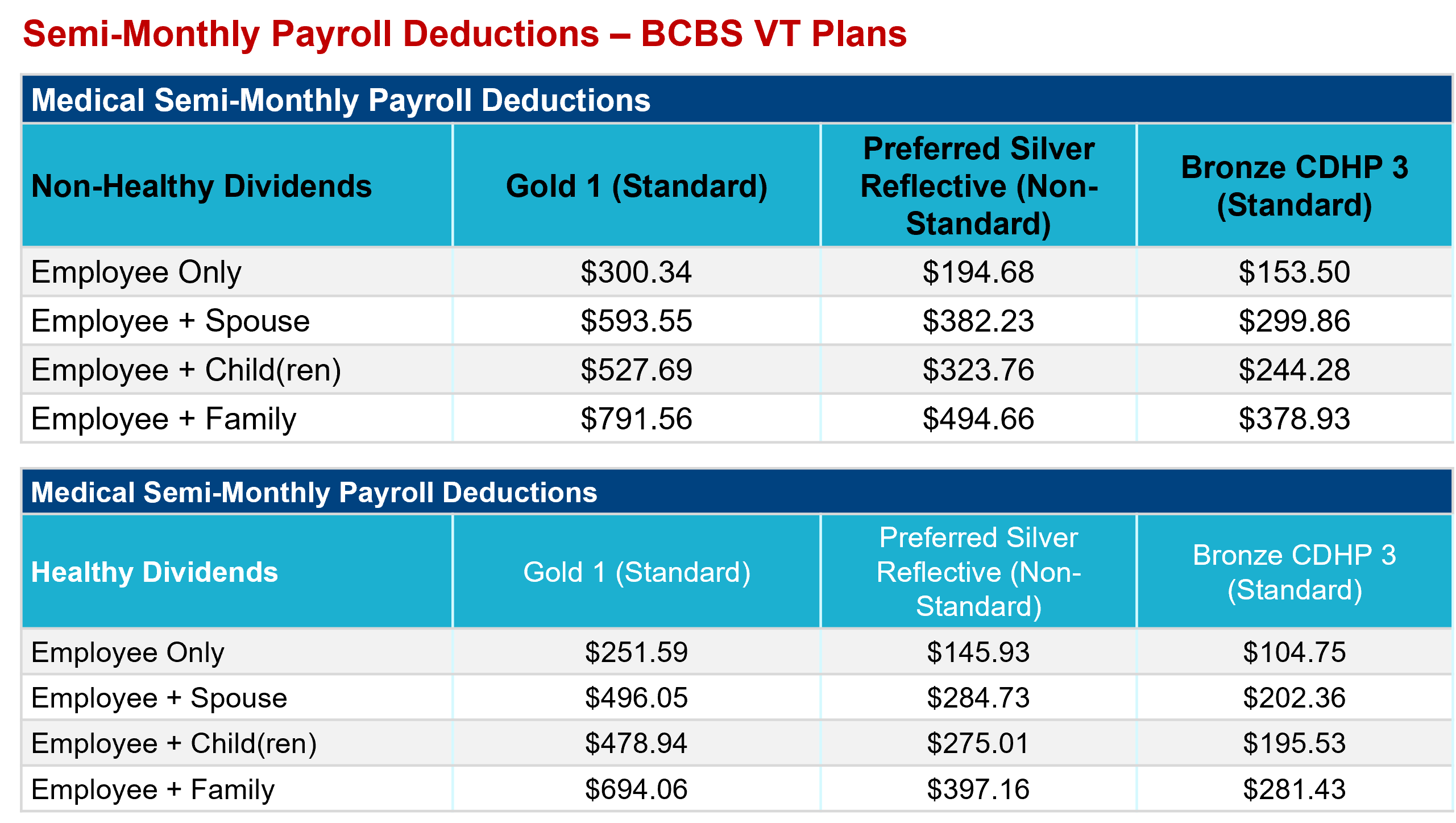

Contributions

BCBS VT Telemedicine – Amwell

Visit a doctor and receive prescriptions from the comfort of your home!

Sick on a weekend? Worried about a feverish baby in the middle of the night? Advice from a board-certified doctor is as close as your computer, tablet, or smart phone. BCBS VT partners with American Well (Amwell), a nationally acclaimed telemedicine vendor, to provide you with services 24/7, wherever you are. This service is available via the Amwell app or by phone.

Top 10 Conditions for members using Telemedicine:

- Sinus Infection

- Upper respiratory infection

- Bronchitis

- Urinary tract infection

- Sore throat

- Pinkeye

- Influenza

- Cough

- Allergies

- Asthma

How to Sign Up

- Download the Amwell app from the App Store or Google Play, or visit www.amwell.com

- Register for your virtual visit. You will need your BCBS VT ID card.

- Select “BCBS VT” from the dropdown menu in the Health Plan field when prompted.

- Select “Medical” when prompted to choose the type of service you want.

- Select a doctor from the list of doctors available to you.

- Answer some general health questions and some questions about your current medical issue.

That’s it! You’ll watch a short Amwell welcome video and be directed to the virtual “waiting room” for your provider.

For additional assistance, call (844) 433-3627 or visit https://www.bluecrossvt.org/find-doctor/telemedicine-care.

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 60 days of employment.

Contact Information

Phone – 800-247-2583

Website – Blue Cross Member Services | BlueCross BlueShield of Vermont

Please click here for the BCBS VT Provider Directory

Please click here for the list of covered Prescription Medications | BlueCross BlueShield of Vermont

Contact Information

Phone – (844) 433-3627

Website – https://www.bluecrossvt.org/find-doctor/telemedicine-care

Forms

Additional Information

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

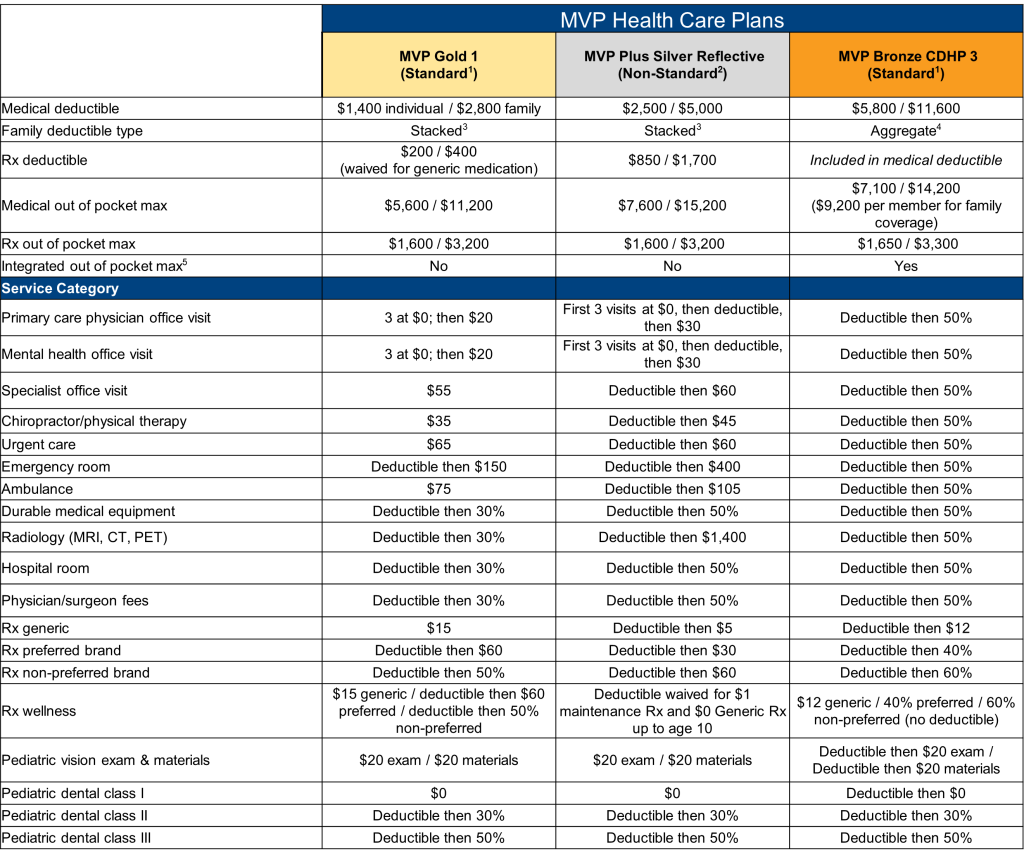

Your MVP Health Care Medical Benefits

Fulflex offers 3 medical plans from MVP Health Care:

- Gold 1 (Standard)

- Plus Silver Reflective (Non-Standard)

- Bronze CDHP 3 (Standard)

MVP Health Care Plan Details

Deductibles — The amount you pay each year for eligible in-network and out-of-network charges before the plan begins to pay a portion of the costs.

Copays — A fixed amount you pay for a health care service. Copays do not count toward your annual deductible but do count toward your annual out-of-pocket maximum.

Coinsurances — Once you’ve met your deductible, you and the plan share the cost of care, which is called coinsurance. For example, you may pay 30% for services and the plan pays 70% of the cost until you reach your annual out-of-pocket maximum, depending on which plan you choose.

Out-of-pocket maximums— The most you will pay each year for eligible in- or out-of-network services, including prescriptions. After you reach your out-of-pocket maximum, the plan pays the full cost of eligible health care services for the rest of the year.

1 A Standard health plan provides the same plan design (deductibles, copays, and covered services) across multiple insurance companies, making it easier to compare plans. Standard plans of the same type from different carriers (e.g. the BCBS VT Gold 1 Plan and the MVP Gold 1 Plan) have the same plan design but differ in their provider networks and premiums.

2 A Non-Standard health plan is customized with variations in coverage and pricing beyond the standardized options. These plans offer more variety in plan design and can vary significantly in plan design across different insurance companies. For example, the non-standard Silver Reflective plans of BCBS VT and MVP differ greatly in their deductibles, copays, and cost sharing.

3 A plan with a Stacked family deductible pays benefits to each covered family member who reaches their individual deductible. For example, under the MVP Gold 1 Plan, each individual family member would need to spend $1,400 in medical expenses for their deductible to be reached, and then the plan would start paying expenses for that individual.

4 In a plan with an Aggregate family deductible, the entire family must meet a single deductible amount (regardless of how individual expenses are accrued across covered family members on the plan) before the plan will start paying for benefits. For example, under the MVP Bronze CDHP 3 Plan, all family members covered under the plan must meet the $11,600 deductible collectively (as opposed to $5,800 individually).

5 A plan has an Integrated Out-of-Pocket Maximum when the maximum out-of-pocket amount you pay is combined for both medical and pharmacy services.

MVP Health Care Medical Plans – Summary of Benefits and Coverages (SBCs)

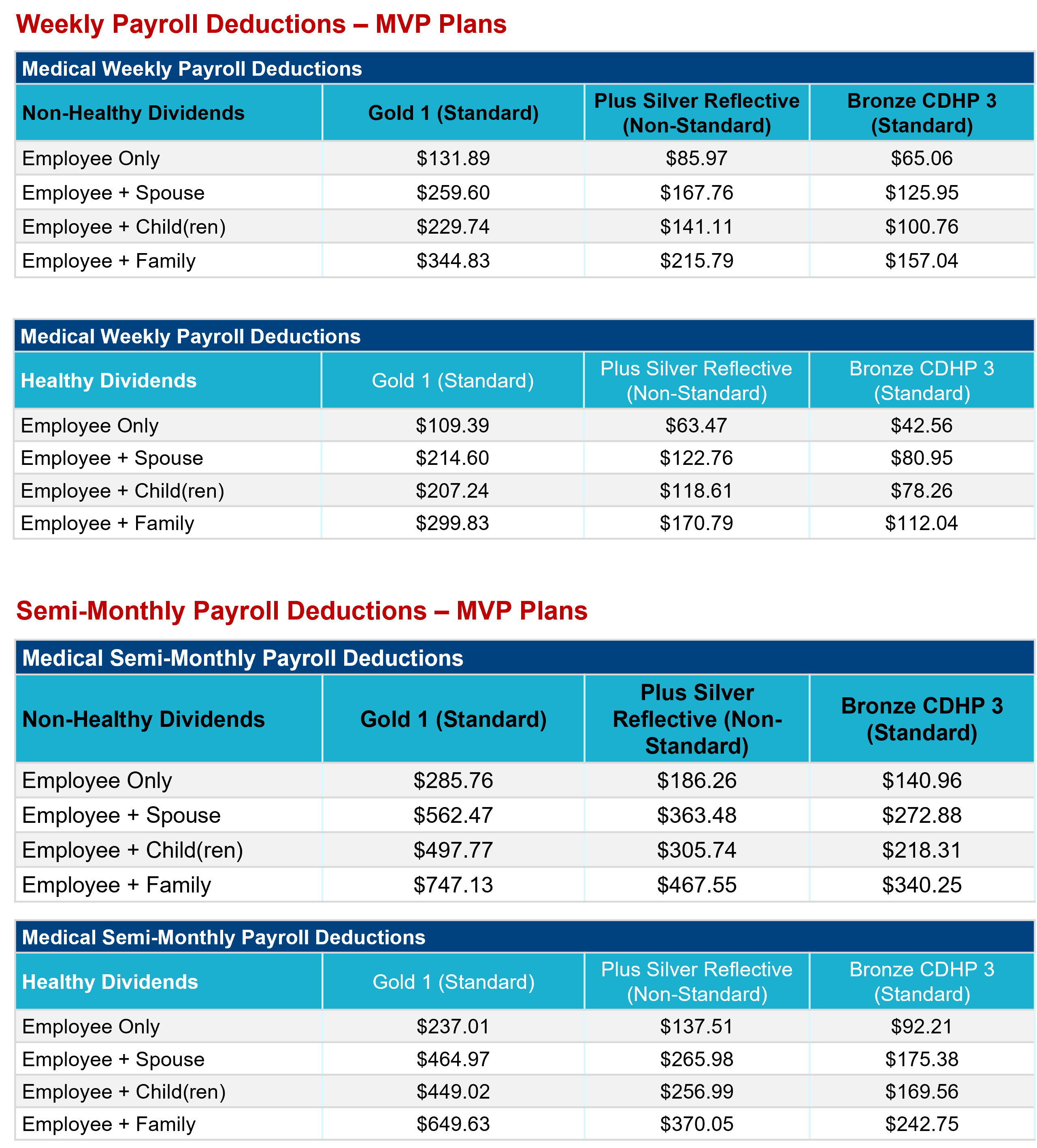

Contributions

MVP Telemedicine – Gia

If you select an MVP medical plan, you will have access to Gia, their telemedicine platform. With Gia, you can message a board-certified doctor 24/7 or get same-day virtual care and prescriptions.

Gia is an ideal resource when you are unable to get an appointment with your primary care provider or when you are traveling out of town. Gia can help with a wide range of common and urgent medical needs, including:

- Cough, stuffy nose, congestion, post-nasal drip

- Fever

- Sore throat or difficulty swallowing

- Symptoms of RSV (wheezing, coughing, fever)

- Ear pain or other symptoms of ear infection (trouble sleeping, fever, tugging on ear)

- Pink eye or stye (redness, itching, tearing)

- Urgent support for anxiety or depression

- Headache or migraine

- Nausea, stomach pain, bowel concerns

- Mild allergic reaction and skin irritations (swelling, rash, itching, wheezing)

- Muscle or joint pain

- Insect and tick bites

- Minor injuries, cuts, scrapes, burns

- Pain while urinating, frequent urge to urinate, or blood in urine

To get started, download the Gia app from the App Store or Google Play.

For additional assistance, call 1-877-GoAskGia (1-877-462-7544) or visit https://www.mvphealthcare.com/when-should-i-use-gia

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 60 days of employment.

Contact Information

Phone – 888-687-6277

Website – www.mvphealthcare.com

Please click here for the MVP Provider Directory

Please click here for the MVP Formulary Drug List (select 2025 MVP Marketplace Formulary)

Contact Information

Phone – (877) 462-7544

Website – https://www.mvphealthcare.com/when-should-i-use-gia

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Your Healthy Dividends Benefits

Employees participating in the Fulflex medical plan can earn a lower Healthy Dividends paycheck premium contribution by participating in specific annual wellness activities.

To obtain the Healthy Dividends premiums, the requirements are as follows:

- Provide confirmation that you and your spouse met with your physician for an annual wellness exam between March 1, 2024 and February 28, 2025 and provide Fulflex with confirmation of the visit.

If the physician visit is not completed and confirmed with HR by February 28, 2025, the full non-Healthy Dividend premium will be charged retroactive to January 1, 2025.

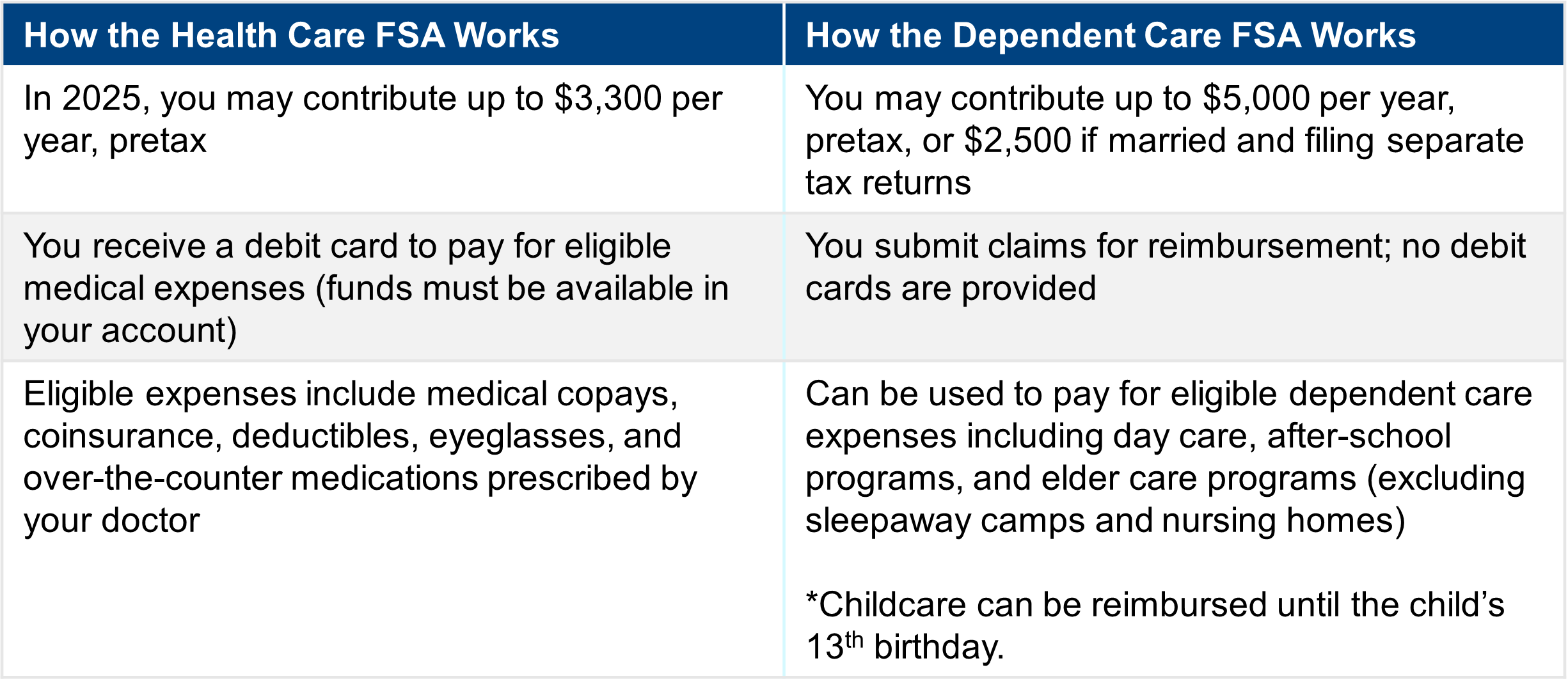

Your Flexible Spending Account and Dependent Care Account Benefits

Flexible Spending Account (FSA)

Funds from an FSA can be used for qualified expenses including deductibles, co-payments, and coinsurance for medical, dental, and vision. With an FSA, the entire elected amount is available on the first day of the health plan year.

2025 Contribution Limits:

- Minimum contribution: $100

- Maximum contribution: $3,300

- Rollover amount: $660

You will have the ability to rollover any unused funds up to $660 from 2025 into 2026. Any remaining funds in excess of $660 will be forfeited.

Dependent Care Account (DCA)

A Dependent Care FSA allows employees to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care.

2025 Contribution Limits:

- Minimum contribution: $100

- Maximum contribution: $5,000 (if single or married & filing jointly) or $2,500 (if married & filing separately)

- No rollover amount

Eligible Day Care Expenses:

- Childcare/Adult Care by a licensed childcare facility for children under age 13 who qualify as dependents on your federal income tax return

- Childcare/Adult Care for children or adult of any age who are physically or mentally unable to care for themselves and who qualify as dependents

Ineligible Day Care Expenses

- Child support payments

- Food, clothing and entertainment

- Educational supplies and activity fees

- Cleaning and cooking services not provided by the day care provider

- Overnight camp

- Nursing homes

Healthy Dollars Website Instructions

Employees who participate in an FSA will be issued a debit card to pay for eligible expenses. Employees will be responsible for managing their FSA and/or DCA accounts on the Healthy Dollars website.

To Register:

- Login at www.healthydollarsinc.com

- Click on “Employee Login”

- Click on “Register”

- Select a Username (between 5-16 characters); Select a Password (follow instructions for requirements)

- Enter your first and last name, email address, employee ID (social security number with no dashes)

- Registration ID: use the drop down menu to select the Card Number, enter 16 digit card number in the space

- Make sure to accept terms of use

- Click on the ? Mark bubbles to get additional help

Once your registration is complete, you can:

- View FSA/DCA plan activity

- Receive claim/reimbursement notices

- Submit claims if needed

Eligibility

All full-time employees who work at least 30 hours per week are eligible on the 1st of the month following 60 days of employment.

Contact Information

Phone – 877-900-6979

Website – www.healthydollarsinc.com

Email – service@healthydollarsinc.com

Forms

Additional Information

FSA Store

Fulflex has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

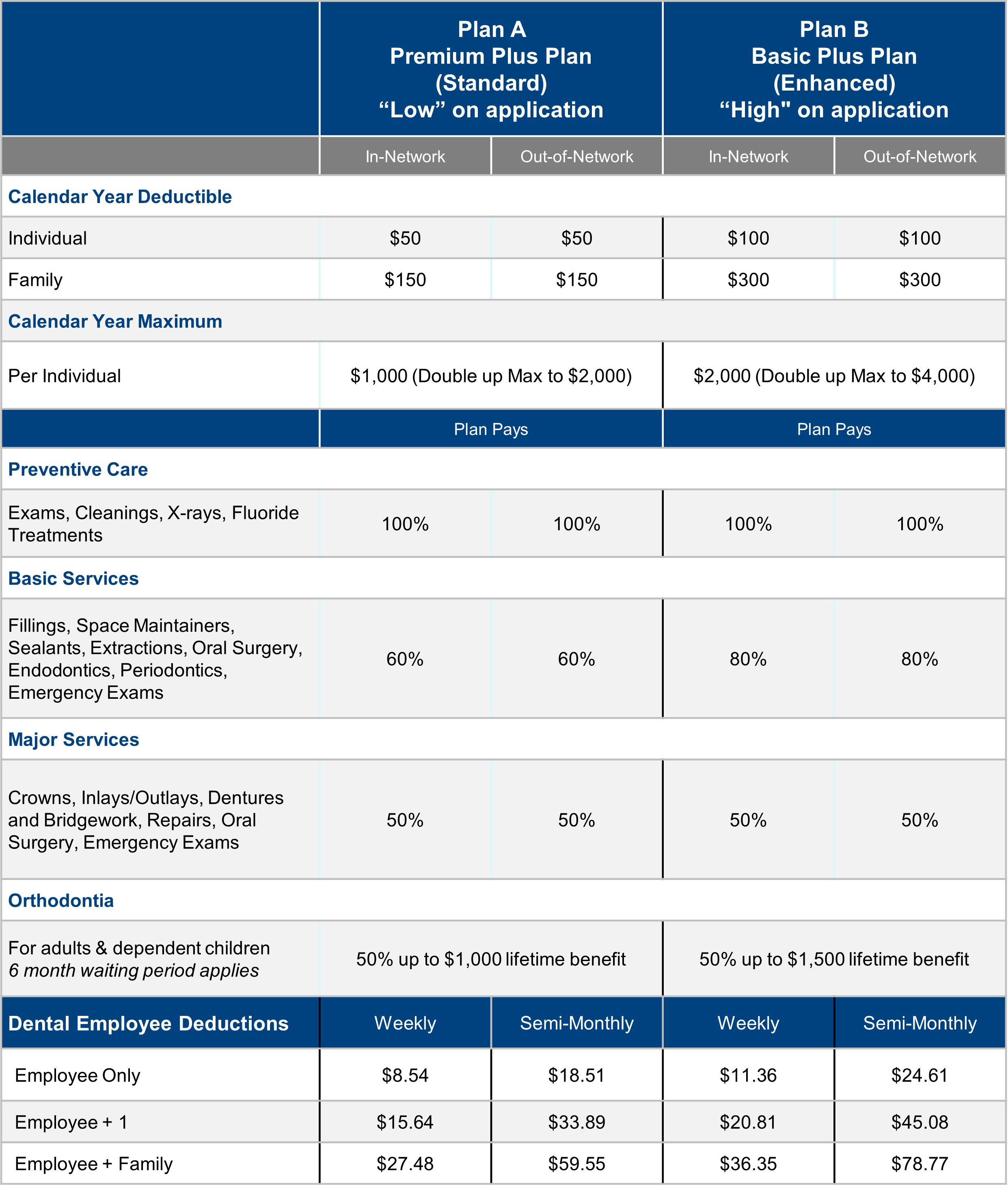

Your Dental Benefits

Fulflex offers dental coverage through Delta Dental. You may enroll yourself and your eligible dependents — or you may waive dental coverage. You do not have to be enrolled in medical coverage to elect a dental plan.

Taking care of your oral health is not a luxury; it is necessary for optimal long-term wellness. With a focus on prevention, early diagnosis, and treatment, dental coverage can greatly reduce the cost of restorative and emergency procedures. Preventive services at in-network providers are generally covered at no cost to you and include routine exams and cleanings. You pay a small deductible and coinsurance for basic and major services.

Most in-network preventive cleanings and exams are covered at 100%.

You may receive dental care in or out-of-network. However, when you go out of network, the provider can charge more and the plan will only reimburse up to the reasonable and customary rates.

Plan Details & Contributions

Double-Up Max

Your Northeast Delta Dental Plan allows you to double your calendar year maximum by earning an additional $250 per year for use in future benefit periods.

Here is how it works:

- To qualify for the carryover, you must have a claim paid for either an oral exam or a cleaning during a calendar year (a focus on prevention), and your total paid claims cannot exceed $500 during the same calendar year.

- The carryover will accumulate for each year of qualification up to an amount equal to the plan’s original calendar year maximum. If, for example, the calendar year maximum is $2,000, enrollees can ultimately achieve an annual maximum of $4,000.

HOW Program (Health Through Oral Wellness)

A healthy mouth is part of a healthy life, and Northeast Delta Dental’s innovative HOW program works with your dental benefits to help you achieve and maintain better oral wellness. HOW is all about you because it’s based on your specific oral health risk and needs. Best of all, it’s secure and confidential.

Here’s how to get started:

- Go to www.healththroughoralwellness.com and click on “Register Now”.

- After you register, please take the free oral health risk assessment by clicking on “Free Assessment” in the Know Your Score section of the website.

- The next step is to share your results with your dentist at your next dental visit. Your dentist can discuss your results with you and perform a clinical version of the risk assessment.

Northeast Delta Dental – EyeMed Vision & Hearing Discount Program

EyeMed’s vision and hearing discount program is available free to all Northeast Delta Dental subscribers and their dependents. To claim your discount, simply present your Delta Dental member ID card or the flyer below when you arrive at the provider office or location. Your EyeMed provider will take care of the rest!

Your EyeMed Vision Care includes:

- Up to 35% off eyewear

- Additional discounts on exams, lenses, frames, and more

- Access to optometrists, ophthalmologists, opticians, and the nation’s leading optical retailers

Your Hearing Discount includes:

- 40% off hearing exams

- Discounted, set pricing on thousands of hearing aids

- 3-year warranty plus loss and damage coverage

For more information, visit: EyeMed Vision and Hearing Discount | Northeast Delta Dental

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 90 days of employment.

Contact Information

Phone – 800-329-2011

Dentist Directory | Delta Dental Providers | Dentist Near Me

(select “PPO Plus Premier” network)

Plan Documents

Forms

Flyers

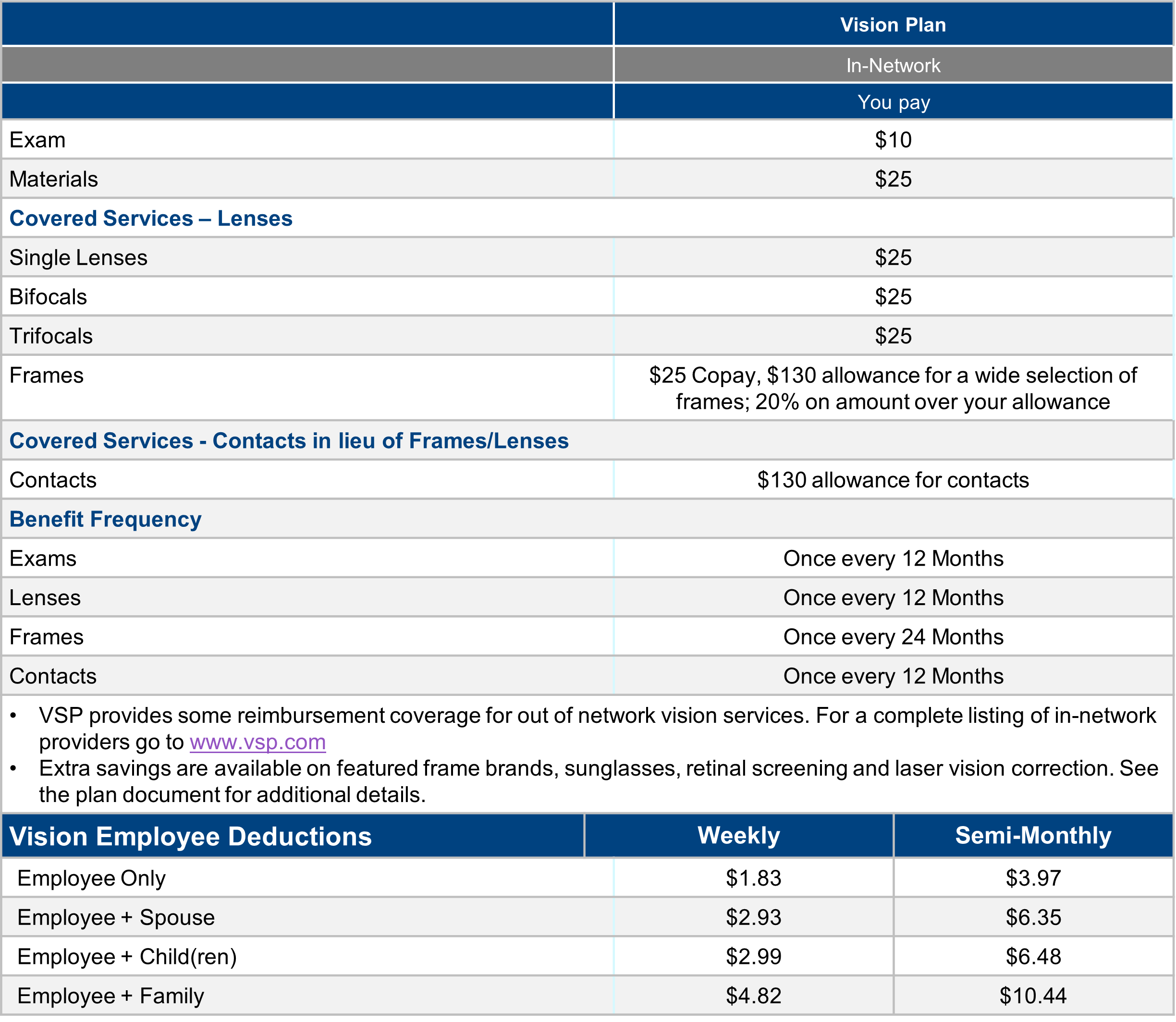

Your Vision Benefits

Fulflex offers vision coverage through VSP. You may enroll yourself and your eligible dependents — or you may waive vision coverage. You do not have to be enrolled in medical coverage to elect a vision plan.

The table below summarizes the key features of the vision plan. Please refer to the official plan documents for additional information on coverage and exclusions.

Plan Details & Contributions

VSP Exclusive Member Extra – TruHearing

TruHearing is making hearing aids affordable by providing exclusive savings to all VSP members. You can save up to 60% on a pair of hearing aids with TruHearing pricing. What’s more, your dependents and even extended family members are eligible.

- In addition to great pricing, TruHearing provides you with:

- Three provider visits for fitting, adjustments, and cleanings

- A 45-day money back guarantee

- Three-year manufacturer’s warranty for repairs and one-time loss and damage

- 48 free batteries per hearing aid

Learn more about this VSP Exclusive Member Extra here:

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 90 days of employment.

Your Group Life & AD&D Benefits

Group Life & AD&D Insurance is provided by the Hartford.

Life insurance, provided by The Hartford, pays a lump-sum benefit to your beneficiaries to help meet expenses in the event you pass away. Accidental death and dismemberment (AD&D) insurance pays a benefit if you die or suffer certain serious injuries as the result of a covered accident. In the case of a covered accidental injury (such as loss of sight or the loss of a limb), the benefit you receive is a percentage of the total AD&D coverage you elected based on the severity of the accidental injury.

Benefit Overview

- Coverage is 1x annual salary to a maximum of $150,000.

- Benefits reduce by 35% at age 70 and by 50% at age 75.

- Employees and spouses who elect coverage when they are first eligible can elect up to the Guaranteed Issue (GI) amount without Evidence of Insurability (EOI).

Contributions

This benefit is 100% employer paid.

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 90 days of employment.

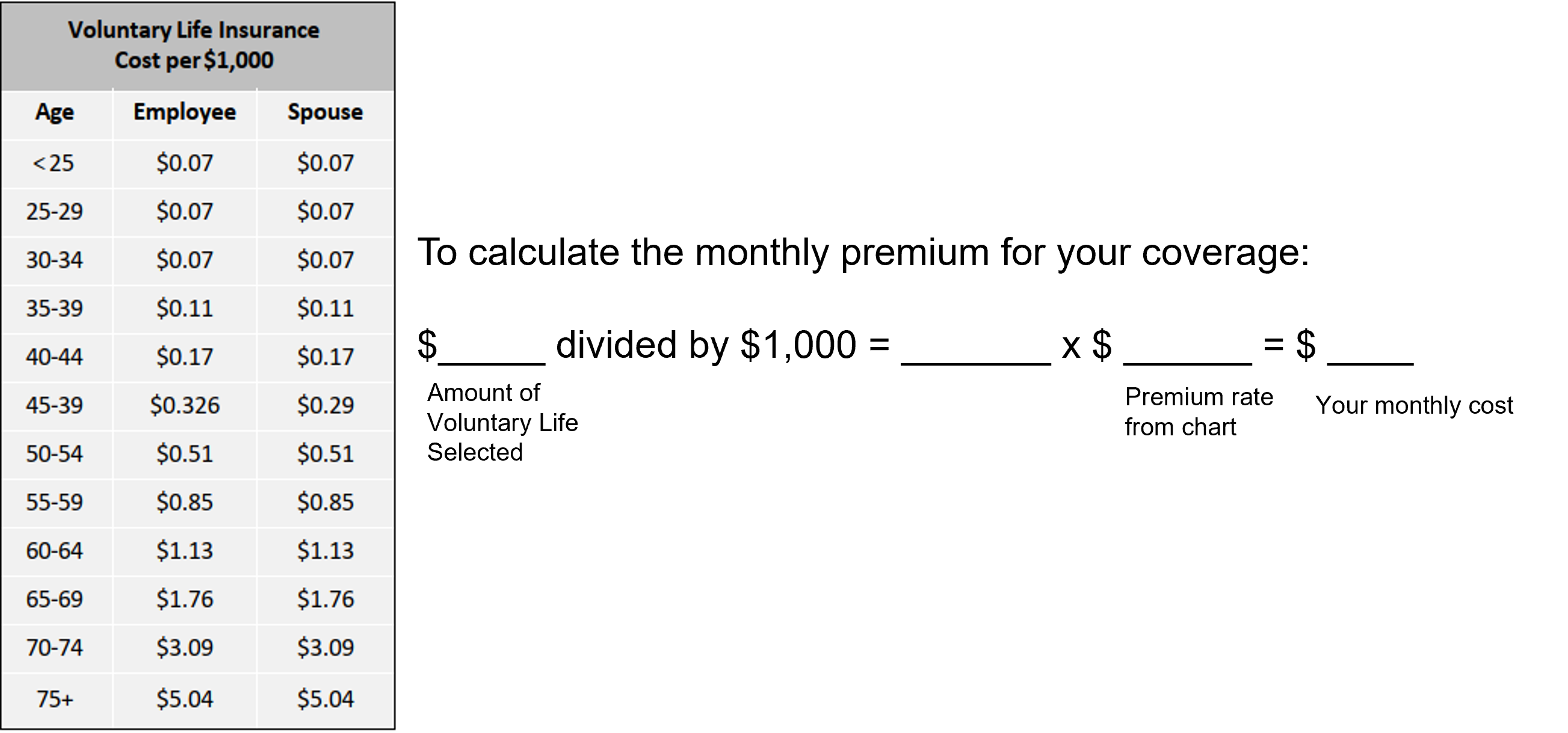

Your Voluntary Life Benefit

Voluntary Life Insurance is provided by the Hartford.

Voluntary life insurance allows you to tailor coverage for your individual needs and provide financial protection for your beneficiaries in the event of your death.

Benefit Overview

| Employee | Spouse | Child(ren) up to age 26 | |

Coverage Amount |

From $10,000 up to $500,000 (not to exceed 5x your annual earnings) | From $5,000 up to $100,000 (cannot exceed 50% of employee coverage amount) | Up to $10,000 in increments of $1,000 for each child age 15 days to age 26 |

Guaranteed Issue |

Lesser of 3x annual earnings or $200,000 | $30,000 | No medical information is required. |

Evidence of Insurability/ Proof of Good Health |

Refer to Plan Documents | Required if electing coverage over the Guaranteed Issue amount. | Not required. |

Contributions

This benefit is 100% employee paid.

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 90 days of employment.

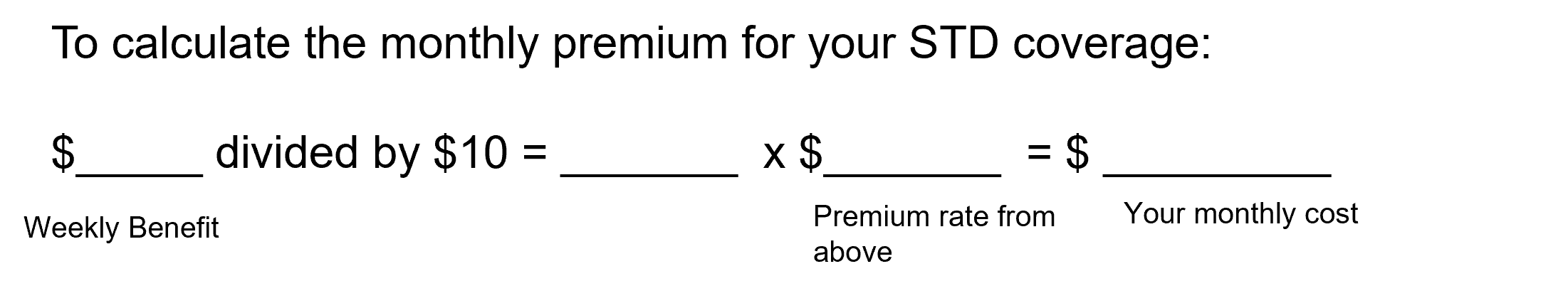

Your Voluntary STD, Accident, & Critical Illness Benefits

Voluntary Short-Term Disability, Accident, & Critical Illness Insurance is provided by the Hartford.

Short-Term Disability

Short-Term Disability insurance can help you remain financially stable by providing a portion of your income if you become disabled and are unable to work.

- Weekly benefit ranges from $200 to $300 per week

- Benefit duration is 26 weeks

- No waiting period following date of disability

- STD benefit cost per $10 is $1.16

Accident

Accident insurance pays a lump sum benefit for treatment or services incurred by a covered person injured in a non-occupational life-threatening accident.

Critical Illness

- Pays a lump sum benefit for a covered person diagnosed with a covered critical illness

- Employee coverage amounts: $10,000 or $20,000; Guarantee issue amount:$20,000

- Spouse coverage amounts: 50% of employee’s coverage amount

- Child(ren) coverage amounts: $5,000

Contributions

Your STD, Accident, and Critical Illness benefits are 100% employee paid.

Eligibility

All full-time employees who work at least 30 hours per week are eligible for coverage on the 1st of the month following 90 days of employment.

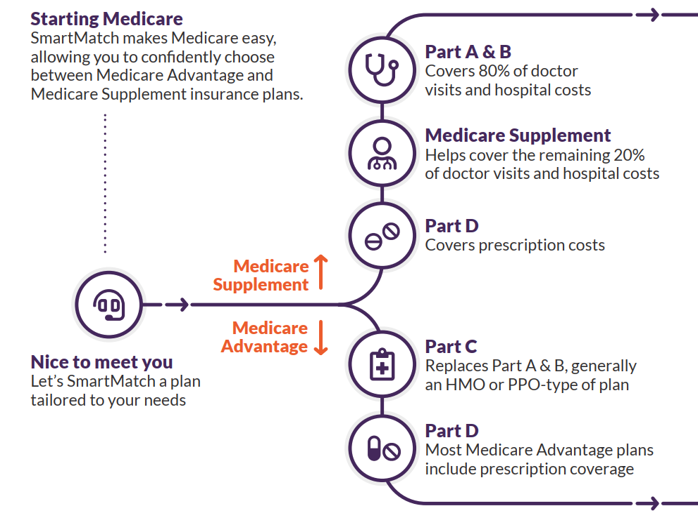

Your SmartConnect – Medicare Navigation Benefits

Fulflex and The Richards Group have partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, SmartConnect tailors solutions designed around your needs. Their agents provide an unfiltered view of the entire range of options and prices available to you.

Retirement Plan

| Eligibility: You are eligible to make your own contributions to the plan after meeting the requirements of attaining age 18 with 6 months of service. You will become eligible for the employer match after meeting the requirements of attaining age 18 with 1 year of service. |

| Enrollment Dates: Once you have met the eligibility requirements, you can join the plan monthly. |

| Employee Contributions: You may contribute $23,500 for calendar year 2025. Annual limitations are set by the IRS and are subject to change. If you are age 50 or older, you can make an additional catch-up contribution of $7,500. |

| Roth Contributions: Your plan permits Roth after-tax employee contributions as well as Pre-Tax contributions. You can also elect to contribute a combination of both Roth and Pre-Tax. |

| Employer Contributions: Your employer has elected a discretionary match of 50% of the first 5% of compensation. To maximize the employer match, you need to save 5% to get a 2.5% match. |

| Vesting: You will always be 100% vested in the portion of your account attributable to employee contributions. The employer match is subject to a 5-year graded schedule:

Less than 1 year of service = 0%, 1 year of service = 20%, 2 years of service = 40%, 3 years of service: 60%, 4 years of service = 80%, 5+ years of service = 100% |

| Rollovers: Money from other qualified plans may be accepted. |

| Investment Changes: Using Empower’s automated telephone or internet service, you have the ability to review your accounts and transfer funds from one investment option to another, 24-hours a day. |

| Hardship Withdrawals: Hardship withdrawals may be taken in cases of extreme hardship as defined by the IRS. They are limited to the amount of the immediate and heavy financial need. |

| In-Service Withdrawals: In-service withdrawals are permitted by your plan once you attain age 59.5. Early withdrawals, if taken before age 59.5, may be subject to a 10% early withdrawal penalty unless certain exceptions apply. Money distributed from the plan may be taxed as ordinary income in the calendar year that the money is received. |

| Loans: Loans are available. |

Retirement Plan Contacts

email: helpretire@therichardsgrp.com

phone: 802-254-6016

Additional Information

Financial Wellness

Savology

Organizing your finances is key to improving your financial well-being. Get started today with Savology, a web-based financial wellness platform that helps you plan and improve your financial future. Start by taking a financial assessment, and receive customized materials made just for you, with resources such as financial literacy courses and planning modules designed to help improve financial outcomes.

Savology is available as a financial wellness and financial literacy resource to all employees.

To Enroll:

To enroll, go to: Savology sign up link

Additional Information about Savology

Video Demo & Contact Information

email: helpretire@therichardsgrp.com

phone: 802-254-6016

Your Employee Assistance Program

As a Fulflex employee, you and your eligible dependents automatically have access to the Employee Assistance Program (EAP) through Invest EAP.

No enrollment is necessary. It is offered at no charge to you and your family members and provides a valuable resource for support and information during difficult times, as well as consultation on day-to-day concerns.

A call to Invest EAP puts you in immediate touch with Master’s or Doctoral level counselors, 24 hours a day. The counselors will explore your questions and concerns, and will provide information and/or referrals to meet your needs.

EAP is an assessment, short term counseling, and referral service designed to provide you and your family with assistance in managing everyday concerns. EAP offers confidential clinical help for everyday people with everyday problems.

Some areas that Invest EAP can provide assistance with are:

- Family & Relationships

- Financial & Legal Problems

- Alcohol & Drug Use

- Childcare & Eldercare

- Depression & Anxiety

- Grief & Loss

- Stress & Work-Life Balance

This program is strictly confidential; your privacy is protected by law. With only a few obvious exceptions your confidentiality is protected. Nobody from work or your family can find out if you’ve accessed any part of the EAP program and no reports are made to your employer except aggregate utilization reports that do not identify individuals.

Eligibility

All employees are eligible to participate in the EAP.

Contact Information

Your Safety Shoe Allowance

At start of employment, all employees are eligible for an annual safety shoe allowance of up to $125 for one pair of safety shoes. Safety shoes should be purchased at Northeast Mountain Footwear, which has locations in Brattleboro, VT and Swanzey, NH.

Prior to purchasing safety shoes, employees must contact Human Resources, which will make arrangements for Northeast Mountain Footwear to invoice the cost of the shoes directly to Fulflex for payment.

Safety footwear must meet ANSI minimum compression and impact performance standards and be slip resistant. Safety shoes must have a safety toe of steel, alloy, or composite material.

Northeast Mountain Trading Post

580 Canal St

Brattleboro, VT 05301